As the financial world eagerly awaits the first-quarter earnings reports, two of America’s banking giants, JPMorgan and Citigroup, are poised to disclose their financial standings this Friday, April 12th, before the market opens. The performance of these conglomerates is pivotal, especially against the backdrop of a thriving banking sector exemplified by the impressive surge in the Dow Jones U.S. Banks Index compared to the broader S&P500.

Dow Jones U.S. Banks Index Outperforms S&P500

Recent trends in the Dow Jones U.S. Banks Index have showcased remarkable resilience, outshining the S&P500 in both quarter-to-date (QTD) and month-to-date (MTD) performances. The index boasts a 12.86% increase QTD and a 7.98% rise MTD, overshadowing the 10.16% and 3.10% gains of the S&P500, respectively. Analysts attribute this buoyancy to positive market sentiments fueled by the Federal Reserve’s outlook for 2024 and discussions surrounding Quantitative Tightening (QT) tapering, which bode well for bank stocks. This optimism suggests a potential shift towards a favorable market environment reminiscent of the 1995 ‘soft landing scenario’ for bank equities.

JPMorgan: A Giant in the Financial Landscape

JPMorgan stands tall as the world’s largest bank by market capitalization, nearing a staggering $577 billion. Offering an array of financial and investment services across all capital markets, including corporate strategy advising, capital raising, risk management, and brokerage, JPMorgan commands a significant presence in the financial sector.

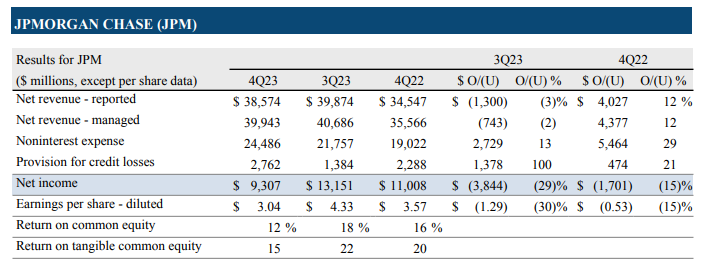

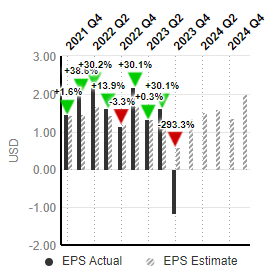

Performance Overview and Projections

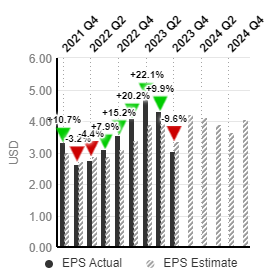

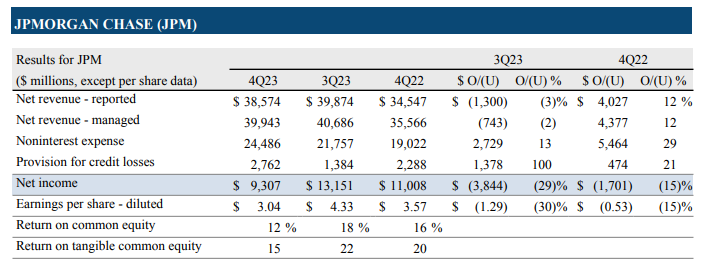

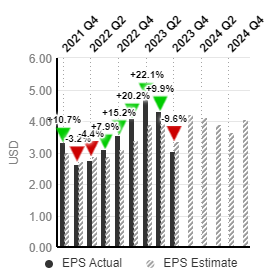

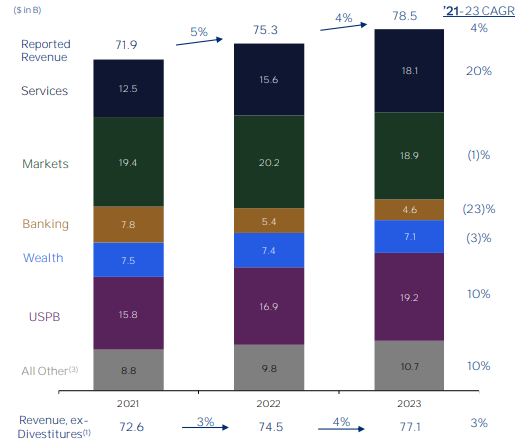

In the fourth quarter of 2023, JPMorgan reported $38.6 billion in net revenue, marking a 12% increase from the prior year. Notably, the Consumer & Community Banking segment emerged as the primary revenue contributor, followed by Corporate & Investment Banking and Asset & Wealth Management. Projections for the upcoming quarter forecast a sales revenue surge to $41.8 billion, with net income expected to reach $19 billion. These estimations signify a substantial improvement from previous quarters, promising an enhanced net margin and earnings per share (EPS) of $4.22.

Citigroup: Navigating Financial Terrain with Resilience

Formed through a historic merger in 1998, Citigroup boasts a market capitalization exceeding $121 billion. Operating through distinct segments like Global Consumer Banking, Institutional Clients Group, and Corporate and Other, Citigroup exhibits resilience amidst market fluctuations.

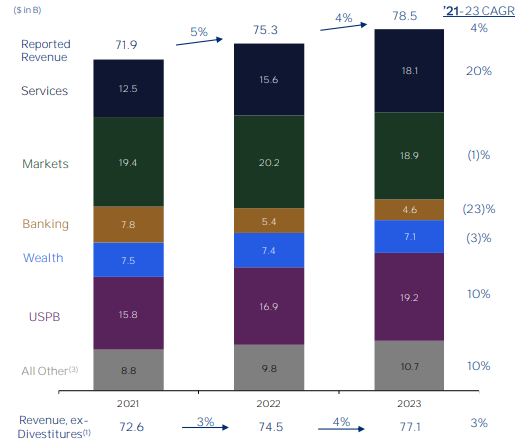

Revenue Trends and Future Outlook

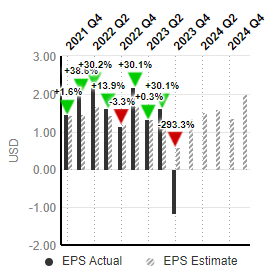

Despite facing challenges in the fourth quarter of 2023, including lower revenues and increased expenses, Citigroup maintained a steady revenue trajectory throughout FY 2023. Notably, projections for the upcoming quarter indicate a rebound in sales revenue to $20.4 billion, with anticipated net income of $2.9 billion. These predictions, though reflecting a year-over-year decline, signal a notable turnaround from previous losses, underlining Citigroup’s adaptability.

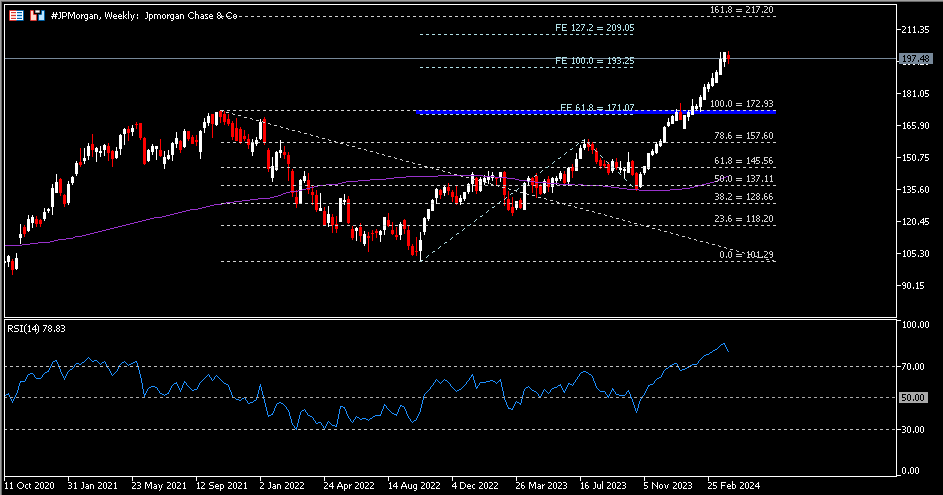

Technical Analysis: Insights into Market Trends

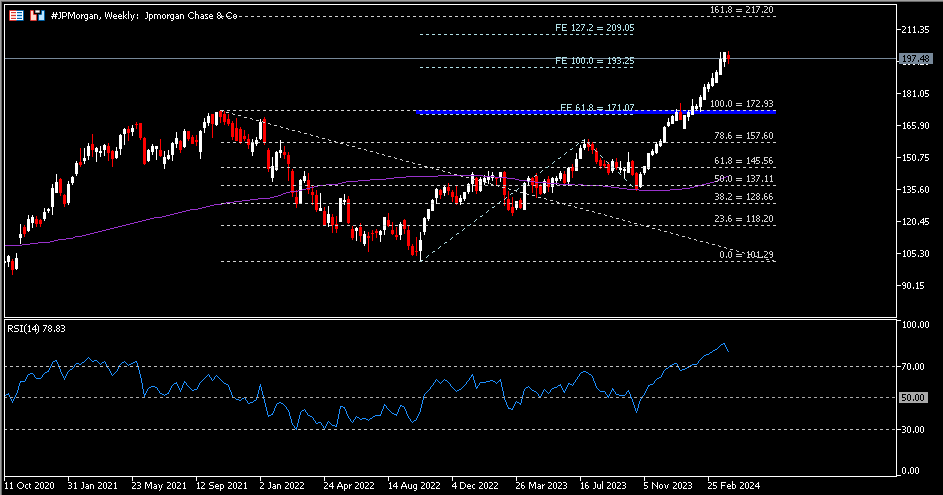

Analysing the technical aspects of JPMorgan and Citigroup’s stock prices reveals intriguing patterns. Both entities have experienced bullish trends, albeit with occasional retracements. JPMorgan’s shares exhibit consistent bullish momentum, albeit with signs of potential correction, while Citigroup’s stock price mirrors a similar trajectory, signaling short-term technical adjustments amidst a broader bullish outlook.

As investors eagerly anticipate the Q1 2024 earnings disclosures from JPMorgan and Citigroup, the banking sector remains poised for continued growth. The performance of these banking juggernauts not only reflects their individual resilience but also serves as a barometer for the broader financial landscape, shaping market sentiments and investor confidence moving forward.