Trading Course

Trading Course

First Steps in Forex Trading – Basic Terminology

- 1. Chapter 2 – First Steps in Forex Trading – Basic Terminology

- 2. Currency Pairs

- 3. Types of Orders

- 4. P.S.M.L

Chapter 2 – First Steps in Forex Trading – Basic Terminology

To trade Forex signals successfully, learn about:

- Currency Pairs

- Types of Orders

- P.S.M.L (Pip; Spread; Margin; Leverage)

Currency Pairs

It is very important to get to know Forex Terminology in order to trade knowledgeably. The terminology is important to be able to read currency price quotes.

Remember: in Forex, each currency is compared to another currency.

Base Currency – The main instrument of a pair. The first currency to appear in a currency quote (on the left). USD, EUR, GBP, AUD, and CHF are the most popular bases.

Quote (Counter) – The pair’s secondary instrument (on the right). One would ask, “How many Quote units do I need to sell in order to buy a single Base unit?”

Remember: When we execute a Buy order, we buy Base by selling Counters (in the example above, we buy 1 GBP by selling 1.4135 USD). When we execute a Sell order we sell Base in order to buy Counters.

Forex quotes always consist of two different prices: the Bid price and the Ask price. Brokers receive different Bid and Ask offers from the interbank market and they pass the best offers to you, which are the quotes you see on the trading platform.

Bid price – Best price at which we can sell the Base Currency in order to buy Quotes.

Ask price – Best price offered by the broker in order to buy Bases in return for a Quote.

Exchange rate – The ratio of one instrument’s value to another.

- When buying currency, you operate an Ask Price action (you relate to the pair’s right-hand side) and when selling currency you are doing a Bid Price action (you relate to the pair’s left-hand side).

- Buying a pair means that we sell Quote units in order to buy Bases. We do so if we believe that the value of the Base will go up. We sell a pair if we believe that the value of the Quote will rise. All Forex trading is done with currency pairs.

Example of a Forex Quote:

The data is constantly running live. Prices are only relevant for the time they appear. Prices are presented live, moving up and down all the time. In our example, the Base is the euro (left). If we sell it in order to buy the quote currency (right, in our example, dollar), we will sell EUR 1 in exchange for USD 1.1035 (Bid order). If we wish to buy euros in exchange for selling dollars, the value of 1 euro will be 1.1035 dollars (Ask order).

The 2 pip difference between base and quote prices is called the Spread.

The non-stop changes in prices create the profit opportunities for traders.

Another example of a Forex quote:

Like every currency pair, this pair contains 2 currencies, euro and dollar. This pair expresses the “dollars per euro” condition. Buy 1.1035 means that one euro buys 1.1035 dollars. Sell 1.1035 means that by selling 1.1035 dollars we can buy 1 euro.

Lot – Deposit unit. Lots are the currency units we trade with. A lot measures the size of a transaction.

You can trade with more than one open lot if you wish (to reduce risks or raise the potential).

There are a number of different lot sizes:

- Micro lot size consists of 1,000 units of currency (for example – 1,000 US dollars), where each pip is worth $0.1 (assuming we deposit US dollars).

- Mini lot size is 10,000 units of currency, where each pip is worth $1.

- Standard lot size is 100,000 units of currency, where each pip is worth $10.

Lot Type table:

|

Type |

Lot Size |

Pip value – assuming USD |

|

Micro lot |

1,000 units of currency |

$0.1 |

|

Mini lot |

10,000 units of currency |

$1 |

|

Standard lot |

100,000 units of currency |

$10 |

Long position – Go Long or buying a long position is done when you expect the currency rate to go up (in the example above, buying euros by selling dollars, expecting the euro to go up). “Going long” means to buy (expect the market to rise).

Short position – Go Short or Carry on selling is done when you expect a decrease in value (compared to the counter). In the example above, buying dollars by selling euros, hoping the dollar will go up soon. “Going short” means selling (you expect the market to go down).

Example: EUR/USD

| Your Action | EUR | USD |

| You purchase 10,000 Euros at an EUR/USD exchange rate of 1.1035

(BUY position on EUR/USD) |

+10,000 | -10,350 (*) |

| 3 Days later, you exchange your 10,000 Euros back into us dollars at the rate of 1.1480

(SELL position on EUR/USD) |

-10,000 | +14,800 (**) |

| You exit the trade with a $445 profit

(EUR/USD increased 445 pips in 3 days! In our example, 1 pip is worth 1 us dollar) |

0 | +445 |

* 10,000 Euros x 1.1035 = $10,350

** 10,000 Euros x 1.1480 = $14,800

More Examples:

CAD (Canadian dollar)/USD – When we believe that the American market is getting weaker, we buy Canadian dollars (placing a buy order).

EUR/JPY – If we think that the Japanese government is going to strengthen the yen to shrink exports, we will sell euros (placing a sell order).

Types of Orders

Important: it is advised to focus mainly on “Stop-Loss” and “Take Profit” orders (see below). Later on, in more advanced chapters, we will make a thorough study of them, understanding exactly how to use them in practice.

Market order: Buying/Selling execution at the best available market price (the live price quotes presented on the platform). This is obviously the most basic, common order. A market order is actually an order you pass to your broker at the real-time, current prices: “buy/sell this product!” (In Forex, product = pair).

Limit entry order: A Buying order beneath the actual price, or selling order above the actual price. This order allows us to not sit in front of the screen all the time, waiting for this point to appear. The trading platform will automatically execute this order when the price reaches the level we have defined. Limit entry is very efficient, particularly when we believe that this is a turning point. Meaning, at that point the trend will change direction. A good way to understand what an order is is to think of it as setting your TV converter to record e.g.. “Avatar”, which is due to start in a couple of hours.

Stop entry order: Buying order above the existing market price or a selling order beneath the market price. We use a Stop entry order when we believe there is going to be a price movement in a clear, specific direction (uptrend or downtrend).

The two most important orders you need to learn to become a successful trader:

Stop Loss Order: A highly important and useful order! We recommend using it for every trading position you open! Stop loss simply eliminates the chance for extra losses beyond a certain price level. In fact, it is a selling order which will take place as soon as the price meets this level. It is extremely important for traders who are not sitting in front of their computers all the time because the forex market is very volatile. For instance, if you are selling a pair and the price goes up, the trade will close when it reaches the stop loss level and vice versa.

Take Profit order: An exit trade order set in advance by the trader. If the price meets this level, the position will automatically be closed, and traders will be able to collect their profits up to that point. Unlike a Stop loss order, with a Take Profit order, the exit point is in the same direction as market expectations. With Take Profit we can ensure at least some profits, even if there might be the possibility to gain more.

More advanced orders:

GTC – Trading is active until you cancel it (Good Till Cancelled). The trade will stay open until you manually close it.

GFD – Good for the Day. Trade until the end of the trading day (usually according to NY time). The trade will automatically be closed at the end of the day.

Tip: If you are not an experienced trader, do not try to be a hero! We advise you to stick with basic orders and avoid the advanced orders, at least until you will be able to open and close positions with your eyes closed… You must perfectly understand how they work in order to use them. It is important to first practice Take Profit and Stop Loss!

Volatility – Level of instability. The higher it is, the higher the level of trading risk and greater the winning potential as well. Liquid, volatile market tells us that currencies are changing hands in large volumes.

P.S.M.L

(Pip; Spread; Margin; Leverage)

When looking at a currency table on your trading platform, you will notice that the price of the various currencies tends to jump up and down. This is called “fluctuation”.

Pip – The smallest price movement of a currency pair. One pip is the fourth decimal place, 0.000x. If EUR/USD rises from 1.1035 to 1.1040, in trading terms it means 5 pips movement upwards. Nowadays, brokers are offering prices within a decimal of the pip, such as 1.10358… but we’ll explain this in detail below.

Any pip, of any currency, is translated into money and automatically calculated by the online trading platforms you trade on. The trader’s life has become really simple! There is no need to calculate data by yourself. You just need to fit them into your own wishes and expectations.

Remember: If a pair includes Japanese yen (JPY), then the quotation of the currencies goes 2 decimal places out, to the left. If the pair USD/JPY moved from 106.84 to 106.94 we can say that this pair went up 10 pips.

Important: Some trading platforms present quotations showing five decimals. In these cases the fifth decimal is called a Pipette, a fractional pip! Let’s take EUR/GBP 0.88561. The fifth decimal is worth 1/10 pip, but most brokers do not show pipettes.

Profits and losses are not only calculated in money terms, but also in the “language of pips”. The pips jargon is the common way of speaking when you enter the Forex traders’ room.

Spread – The difference between the buying price (Bid) and selling price (Ask).

(Ask) – (Bid) = (Spread). Take a look at this pair quotation: [EUR/USD 1.1031/1.1033]

The spread, in this case, is – 2 pips, right! Just remember, the selling price of this pair is 1.1031 and the buying price is 1.1033.

Margin – The capital that we will need to deposit in ratio to the capital we want to trade with (a percentage of the trading amount). For example, let’s assume that we deposit $10, using a 5% margin. We can now trade with $200 ($10 is 5% of $200). Say we bought euro in ratio of 1 euro = 2 dollars, we bought 100 Euros with $200 with which we are trading. After one hour the EUR/USD ratio goes up from 2 to 2.5. BAM! We have gathered a $50 profit, because our 200 Euros are now worth $250 (ratio = 2.5). Closing our position, we exit with $50 earnings, all this with an initial investment of $10!! Imagine that in return for your initial deposits you get “loans” (without having to worry to pay them back) from your broker, to trade with.

Leverage – Risk level of your trade. Leverage is the degree of credit you wish to get from your broker on your investment when opening a trade (position). The leverage that you ask for relies on your broker, and most importantly, on whatever you feel comfortable trading with. X10 leverage means that in return for a $1,000 transaction, you will be able to trade with $10,000. You cannot lose a higher amount than the amount you have deposited in your account. Once your account reaches the minimum margin required by your broker, let´s say $10, all your trades will close automatically.

The main task of leverage is to multiply your trading potential!

Let’s go back to our example – a 10% rise in the Quote price will double your original investment ($10,000 * 1.1 = $11,000. $1,000 profit). However, a 10% decrease in the quote price will eliminate your investment!

Example: Say we enter a long position (remember; Long = Buy) on EUR/GBP (buying Euros by selling pounds) at a ratio of 1, and after 2 hours the ratio suddenly jumps to 1.1 in favor of the euro. In these two hours we made a profit of 10% on our total investment.

Let’s put that into numbers: if we opened this trade with a micro lot (1,000 Euros), then how on top are we? You guessed right – 100 Euros. But wait; say we opened this position with 1,000 Euros and a 10% margin. We chose to leverage our money x10 times. In fact, our broker provided us with an additional 9,000 Euros to trade with, so we actually entered the trade with 10,000 Euros. Remember, we gained in these two hours 10% earnings, which has suddenly turned into 1,000 Euros (10% of 10,000)!

Thanks to the leverage we just used we are showing 100% profit on our initial 1,000 Euros that we took from our account for this position!! Hallelujah! Leverage is great, but it is also dangerous, and you must use it as a professional. Therefore, be patient and wait until you have finished this course before jumping in with high leverage.

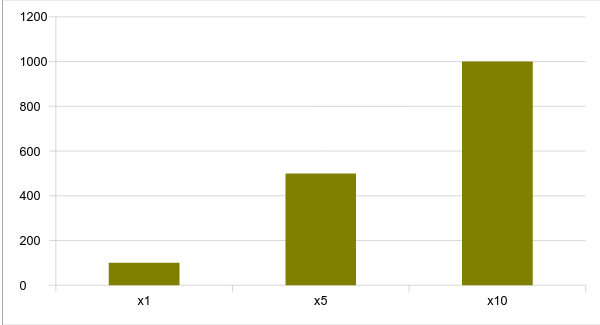

Now, let’s check different potential profits according to different levels of leverage, related to our numerical example:

Profits in Euros at various leverage

Hopefully, you have a better understanding of the outstanding potential to reach profitable investments that the Forex market offers. For us traders, leverage constitutes the widest window of opportunities in the world, to make impressive profits on relatively small capital investments. Only the Forex market offers such opportunities, you will learn how to recognize these opportunities and use them in your favor.

You must remember that proper use of leverage will give you the opportunity to make nice gains but incorrect use of leverage can be dangerous for your money and may create losses. Understanding leverage is critical to becoming a good trader.

Chapter 3 – Synchronize Time And Place for Forex Trading focuses on the technical aspects of forex signals trading. Be sure to get all the facts on synchronizing Time and Place before starting your Forex trading and choosing a Forex broker.