What to Expect from US Manufacturing and Mtfg Prices PMI?

US manufacturing has been in contraction since October 2022, however, we have seen some decent improvement in the last few months, especially in the manufacturing prices. Analysts are expecting the ISM manufacturing Purchasing Managers’ Index (PMI) to show an improvement to 48.5 points in March from 47.8 points in February. This forecast comes after S&P Global’s flash US PMI data for March indicated a rise in the manufacturing index to a 21-month high of 52.5 points from 52.2 points in the previous month, signaling a significant improvement in the sector’s health, so I think that today’s report will lean on the positive side. This would improve the situation for the USD further,

According to the compiler of the data, further expansions in both manufacturing and service sector output in March contributed to closing off the US economy’s strongest quarter since the second quarter of last year. The survey data also suggest another quarter of robust GDP growth accompanied by sustained hiring, driven by continued growth in new orders.

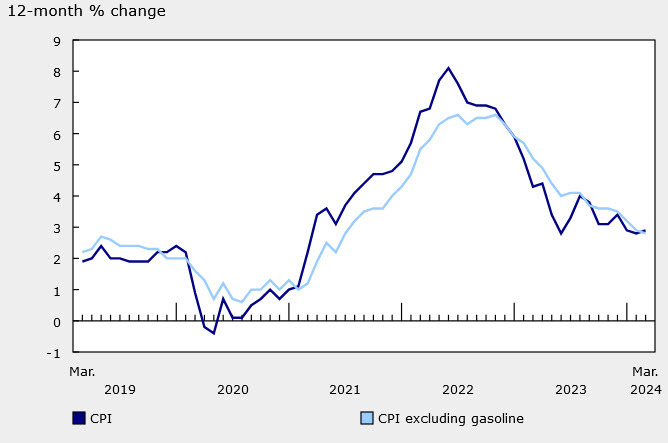

The increase in production in the manufacturing sector is attributed to improving demand for goods both domestically and internationally, which has led to a further increase in company confidence in the outlook. However, analysts will closely monitor the prices paid sub-indices in the ISM data, as S&P Global’s composite flash PMI data warned of increasing inflationary pressures. Input costs rose at the fastest pace in six months, and firms raised their selling prices to the largest extent since April last year.